What's good in Libra Shrugged? Arrogance, exposed.

Facebook’s arrogance, that is. Or immaturity. Or both.

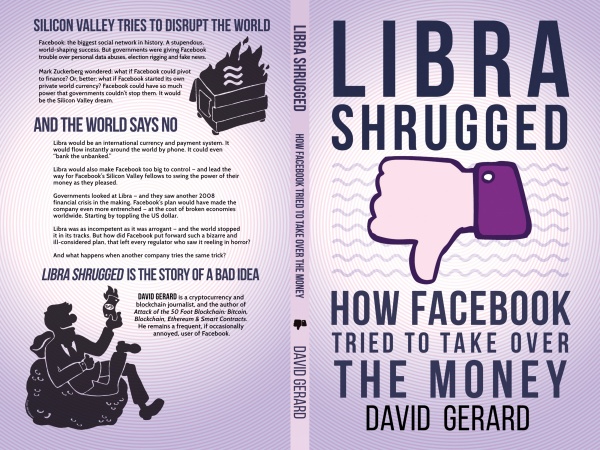

Back in November, I observed that Libra Shrugged, or “How Facebook Tried To Take Over The Money”, looked like “the next book I (and you too) should read”. Since then, I read it, and can confirm that first impression.

The book makes a good, easy to read job of describing the general dangers of having any real, general-purpose currency managed by private, for-profit, unaccountable companies. But even before that, what I like in “Libra Shrugged” is how it exposes the arrogance, provincialism and (which probably is even worse) the immaturity of that company. Or, more generally, how wrong it is a system that lets immature people get so much power.

The best way to show what I mean are the following quotes (partly edited for brevity, emphasis mine), taken from Chapters 1 (“A user’s guide to Libra”) and 9 (“The regulators recoil in horror”):

From Chapter 1: How does [Libra] make my life better? Why should I sign up?

Libra promises a fabulously efficient financial future - “paying bills with the push of a button, buying a cup of coffee with the scan of a code or riding your local public transit without needing to carry cash or a metro pass.”

[BUT] A lot of the problems that Facebook claims Libra solves are really just US retail banking being a few decades behind the rest of the world - sending money between banks can take days, everything has fees, so many things need a phone call, paper checks are still a thing, and so on. But it’s standard in Silicon Valley to propose an all-encompassing international system, and base it entirely on looking out your window in Palo Alto.

The important use cases that Facebook and Libra have put forward are sending money internationally, and giving access to finance to billions of people who don’t have it yet - “banking the unbanked.” They’ve also suggested that more commerce in general will mean Facebook might be able to sell ads for higher prices. They’re not at all clear on the tricky details for any of these.

What’s the point of all this?

This PayPal-but-it’s-Facebook system is [a] fallback position from what [Facebook] originally wanted to build - which was a much weirder system, based on some wild ideas they got from Bitcoin and the other cryptocurrencies. None of these ideas would work at scale, and everything would break. This is what got governments around the world so upset at Libra, so quickly.

From Chapter 9: Why financial regulation exists

If you’re handling other people’s money, then those other people are going to have very particular ideas on how you handle money. So finance has rules and regulations. You can argue the particular rules - but a functional system that you can do business in is going to have regulations, and regulators to oversee them.

Financial regulators are fine with innovation, and want to encourage and help business development - but they know all the ways that cutting corners can go wrong… Regulators need to know that a big new player knows what it’s doing.

If a normal financial institution wants to do something new and unusual, they’ll call the regulators very early in the process. They’ll set out their plans, maybe show them a prototype. If a regulator has concerns, the company will shower them in knowledgeable lawyers to reassure them.

What you don’t do is write up a rough sketch of the system with none of the details filled in, announce that billions of people around the world will use it, then throw the rough sketch over the wall - and expect regulators and legislators to be just fine with this. You don’t go, “yep, we’re doing this, be amazed,” like you’re announcing a video game or an electric truck.

Facebook spent two years working out their blockchain plan and philosophy - and almost none of this time talking to the financial regulators who could sink their financial product with a word.

Facebook seemed actually surprised when all the regulators reacted to their fabulous plans with horror - within hours of them being announced.

A word by me: more books, or requests? Great!

If you have other books you would like me to review, or information I may use here, please email me. To support this whole public service of mine, see here.

Who writes this, why, and how to help

I am Marco Fioretti, tech writer and aspiring polymath doing human-digital research and popularization.

I do it because YOUR civil rights and the quality of YOUR life depend every year more on how software is used AROUND you.

To this end, I have already shared more than a million words on this blog, without any paywall or user tracking, and am sharing the next million through a newsletter, also without any paywall.

The more direct support I get, the more I can continue to inform for free parents, teachers, decision makers, and everybody else who should know more stuff like this. You can support me with paid subscriptions to my newsletter, donations via PayPal (mfioretti@nexaima.net) or LiberaPay, or in any of the other ways listed here.THANKS for your support!