Full fintech ahead, privacy be damned

Seriously. Because, what on Earth could go wrong?

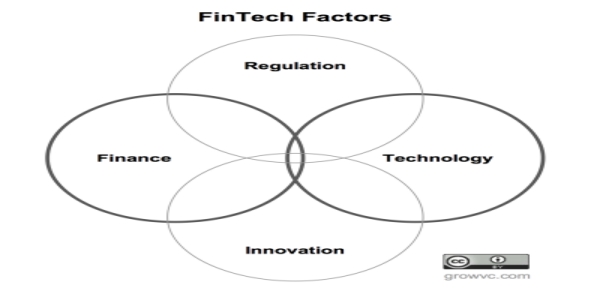

Fintech factors, source: Wikimedia Commons

</em></u>

Fintech, or financial technology, is any way to deliver banking, payments and other financial services through software.

Fintech is undergoing rapid technological changes, accelerated by the increase in demand for digital services triggered by COVID-19. This “raises important questions”, said in late 2020 a blog of the International Monetary Fund (IMF) that, if you ask me, also paints a terrifying picture.

An IMF director at Fintech Festival, source: Wikimedia Commons

</em></u>

Fintech’s potential to reach over a billion unbanked people around the world can be revolutionary. One factor that may power this revolution is “information”, defined in that post as “new tools to collect and analyse data on customers, for example for determining creditworthiness”.

More specifically, the most transformative innovation would be “the increase in use of new types of data coming from the digital footprint of customers' various online activities—mainly for credit-worthiness analysis”.

This strategy would greatly increase the quality of credit scoring of “certain kinds of people, like new entrepreneurs, innovators and many informal workers might not have enough hard data available”.

“Various nonfinancial data”

More fintech would solve that problem by tapping various nonfinancial data, like “the type of browser and hardware used to access the internet, the history of online searches and purchases”.

Relax, “consumer privacy” is safe

To begin with, says the post, “recent research documents that, once powered by artificial intelligence (AI) and machine learning (ML), these alternative data sources are often superior than traditional credit assessment methods, and can advance financial inclusion, by, for example, enabling more credit to informal workers and households and firms in rural areas."

There we go! Never mind AI/ML blunders and discrimination like this, this,this or this. Your rights and access to money are safe.

In the remote case that recent research weren’t enough to make you feel safe, read that whole post. It does mention, among many critical areas where further work is needed. “data policies to ensure consumer privacy”.

Conservatives or not…

To begin with, note how there are no “citizens” nor “people” here, just consumers. Apart from that, certain usages of “internet searches” for credit scoring are something that, as I commented when I first discovered that IMF post, “should scare the living lights out of EVERYBODY with common sense, conservative or not”. I said so because of what I had read in this comment of the IMF call (synthesizing):

“The authors of the piece claim that this move is necessary in order to compete with the rise of corporate cryptocurrencies such as the one in development by Facebook… [But even Facebook’s power] pales in comparison to that of the IMF… [giving IMF] the power to track everyone’s search history can lead to some dark ramifications… the distinction between [the Chinese Social Credit system] and what the IMF is pushing for remains ill-defined”".

“Dark ramifications”: that’s optimism, if I ever saw it.

Who writes this, why, and how to help

I am Marco Fioretti, tech writer and aspiring polymath doing human-digital research and popularization.

I do it because YOUR civil rights and the quality of YOUR life depend every year more on how software is used AROUND you.

To this end, I have already shared more than a million words on this blog, without any paywall or user tracking, and am sharing the next million through a newsletter, also without any paywall.

The more direct support I get, the more I can continue to inform for free parents, teachers, decision makers, and everybody else who should know more stuff like this. You can support me with paid subscriptions to my newsletter, donations via PayPal (mfioretti@nexaima.net) or LiberaPay, or in any of the other ways listed here.THANKS for your support!