Financialization of Big Tech is BIG

It really seems Too Big To Remain.

This post concludes (for 2020, at least) my summaries of an important SOMO report about the main characteristics of the Big Tech model and how it is a mix between feudalism and Animal Farm.

This time, I’ll just share three nuggets, and some of the final remarks, from the part of the report that details something I have already written about, that is how Big Tech is becoming Big Bank.

Assets! FINANCIAL assets.

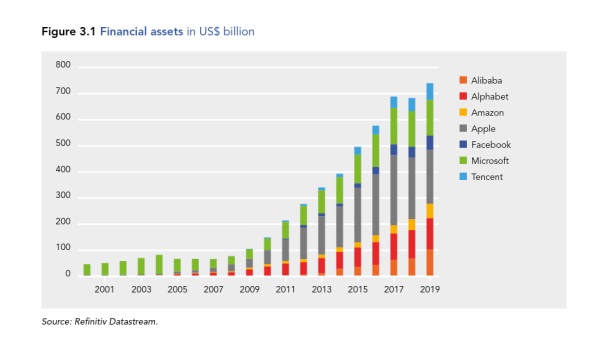

Big Tech companies have “built up significant financial assets, in absolute terms as well as compared to their fixed capital”. Together, the seven major companies had over 700 USD billions. To understand how significant that number really is, consider this: as of December 2020, the “GDP by Country” page at Worldometer lists 189 countries, but only 18 with a GDP greater than 700 USD billions.

State bonds!

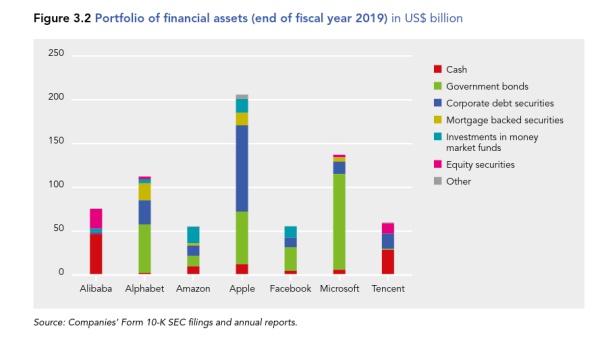

The composition of the financial assets of Big Tech companies is at least as interesting as their nominal volume, because it reflects each corporation’s financial strategy. For the five US corporations, their portfolios clearly show that their preferred investment category is made up of municipal and federal government bonds, from both the US and other advanced economies.

Me: isn’t that as “innovative” as what our grandfathers did with their pensions, just in such volumes that they can make political representatives and city councillors alike listen very carefully when Big Tech speaks?

Debt. It’s cheap!

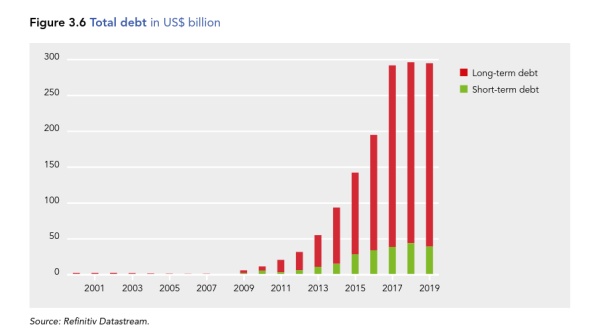

Big Tech corporations have shown an increasing appetite for debt. Since 2014, their total debt has grown from US$94 billion to US$295 billion in 2019, with long-term debt accounting for most of this rise. In today’s low-interest-rate environment, aided by the recent QE policies of the world’s most powerful central banks following the pandemic downturn, some Big Tech corporations were able to obtain their cheapest funds yet.

And this is the result

Mounting financial assets point to the success of rent-generating strategies. Big Tech can acquire whatever they want, in order to continue to “lock in users and practices, create interdependencies, and becomes stronger”.

Summing up, two critical features common to all Big Tech firms are: largely unchecked corporate power, and highly financialised nature.

“Much of the Big Tech model essentially revolves around creating, maximising and monetising network effects… by exploiting their role as gatekeepers and owners of scarce and vital infrastructures”.

“They benefit from the insurmountable information asymmetries vis-à-vis virtually everyone, ranging from users and customers to nascent rivals and regulators."

I know I already said this but… This does not really look like innovation, does it now?

Who writes this, why, and how to help

I am Marco Fioretti, tech writer and aspiring polymath doing human-digital research and popularization.

I do it because YOUR civil rights and the quality of YOUR life depend every year more on how software is used AROUND you.

To this end, I have already shared more than a million words on this blog, without any paywall or user tracking, and am sharing the next million through a newsletter, also without any paywall.

The more direct support I get, the more I can continue to inform for free parents, teachers, decision makers, and everybody else who should know more stuff like this. You can support me with paid subscriptions to my newsletter, donations via PayPal (mfioretti@nexaima.net) or LiberaPay, or in any of the other ways listed here.THANKS for your support!