Big Tech = Feudalism + Animal Farm, digitized. Via tax havens

Because, INNOVATION!!!!, of course.

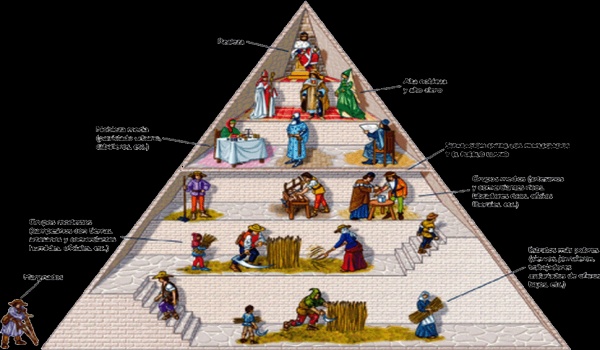

<u><em><strong>CAPTION:</strong>

<a href="https://commons.wikimedia.org/wiki/File:Piramide_feudal.gif" target="_blank">Feudal pyramid, from Wikimedia Commons</a>

</em></u>

Medieval society was structured (at least in Europe) around feudalism, a social hierarchy where very few kings ruled over a few top vassals, who ruled over lower vassals, and so on, down to serf, who had no voice at all, only the obligation to serve. Other societies had similarly rigid, pyramidal structures, some of which still exist today, and are exported. Like, allegedly, indian castes in Silicon Valley. But I digress, let’s look at Big Tech.

This post continues the one about the Big Tech Model, and like that one is a summary of a particularly relevant section of a much larger report, that I strongly invite you to read, about the monopoly of Big Tech Companies like Google, Apple, Facebook, Microsoft and Amazon (GAFAM) and their chinese competitors Alibaba and Tencent.

Stockholders are the new vassals

Some Big Tech companies - notably Facebook and Alphabet, the parent company of Google - have a share structure that consists of multiple classes of shares.

In this structure, explains the report, class A shares carry the right to one vote during the annual shareholder meeting, class B shares carry the right to ten votes and class C shares carry no voting rights at all.

As a consequence, individual shareholders might exert disproportional voting rights compared to the share of the respective company’s stock that they hold. In several Big Tech companies, it’s not “institutional shareholders” like BlackRock, the Vanguard Group, or State Street, who wield the most power. They are just the higher-level vassals, not the kings at the top.

Sergey Brin and Larry Page, the founders of Google, control more than 51% of the voting power in Alphabet, by owning “less than 13% of stock”. Mark Zuckerberg, the founder of Facebook, “owns just 0.17% of the company’s class A shares, but 81.8% of its class B shares. Together with some proxy voting power he exerts for other shareholders, Zuckerberg’s total voting power amounts to 57.9%".

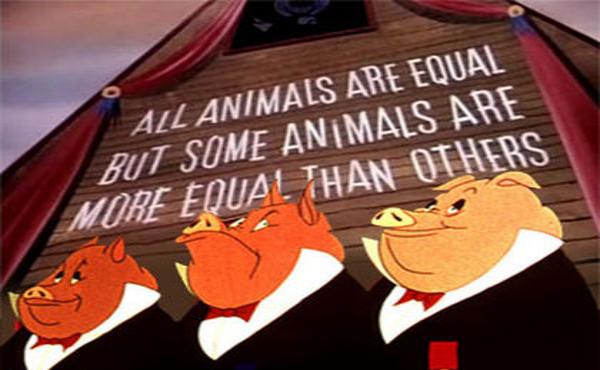

As Orwell would say, from Animal Farm:

“All stockholders are equal, but some stockholders are more equal than others."

Big Tech, or Big Tax Havens?

The offshoring of production is key to the big profit margins of Apple. But all Big Tech firms extensively rely on ‘letterbox’ or ‘shell’ companies - legal entities with no or little physical substance - to claim domicile in a tax haven, enabling them to shift profits, avoid taxes, store wealth and circumvent regulatory requirements.

This is true for all companies, of course, not just those called Big Tech. For them, however, it is even more profitable, because what they produce and own is mostly ownership, or at least de-facto control, of immaterial bits, that can exist and be moved anywhere with a click.

First, Big Tech firms can simply select a jurisdiction to domicile their intellectual property, and hence choose where value is ‘created’.

Second, Big Tech firms also hold (extraordinarily) large stocks of bonds, or other financial instruments, but again in tax-friendly jurisdictions.

Third, subsidiaries in tax havens are often used to circumvent regulations. For example, the parent companies of Alibaba and Tencent are registered in the Cayman Islands, “as a result of Chinese government restrictions on foreign investment in Chinese Big Tech companies”. Being registered in the Caymans enables those companies to access global capital markets.

Free Markets, this is not.

Who writes this, why, and how to help

I am Marco Fioretti, tech writer and aspiring polymath doing human-digital research and popularization.

I do it because YOUR civil rights and the quality of YOUR life depend every year more on how software is used AROUND you.

To this end, I have already shared more than a million words on this blog, without any paywall or user tracking, and am sharing the next million through a newsletter, also without any paywall.

The more direct support I get, the more I can continue to inform for free parents, teachers, decision makers, and everybody else who should know more stuff like this. You can support me with paid subscriptions to my newsletter, donations via PayPal (mfioretti@nexaima.net) or LiberaPay, or in any of the other ways listed here.THANKS for your support!