Algorithm bias, again. This time, in mortgages

But the problem is not algorithms, of course.

Bias and discrimination by algorithms is not new anymore, sadly. But it is always useful to find and share detailed evidence of where and how it happens. This time, I signal some more of such evidence, about Mortgage-Approval Algorithms.

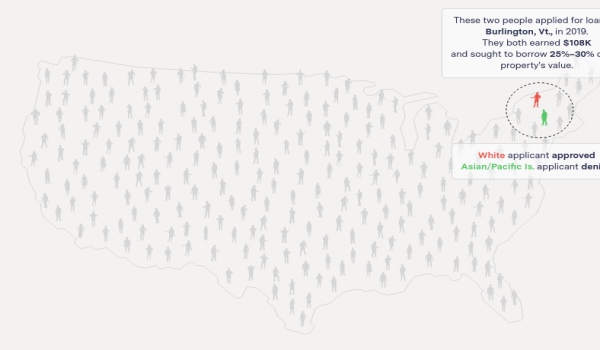

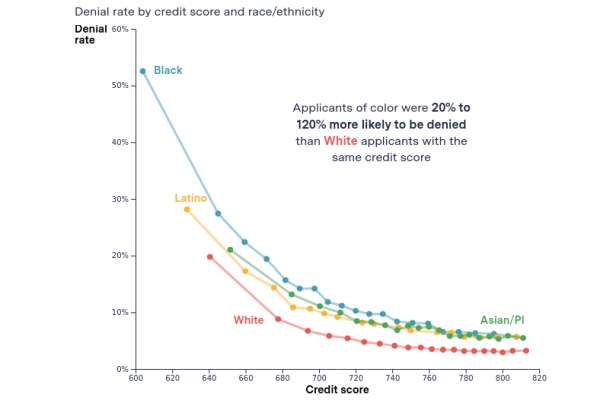

That investigation by The Markup has found that on average, across the USA, lenders were 40% more likely to turn down Latino applicants for loans, 50% more likely to deny Asian/Pacific Islander applicants, and 70% more likely to deny Native American applicants than similar White applicants. Lenders were 80% more likely to reject Black applicants than similar White applicants.

In every case, the prospective borrowers of color looked almost exactly the same on paper as the White applicants, except for their race.

Lenders gave fewer loans to Black applicants than White applicants even when their incomes were high - $100,000 a year or more - and had the same debt ratios, or comparable credit scores.

Who makes these loan decisions? Government agencies, basically

Mortgages in the USA are automatically screened and pre-approved by algorithms, following a credit scoring procedure called “Classic Fico”. If an applicant’s score is less than 620, the mortgage will not be “bought”, that is guaranteed, by Freddie Mac and Fannie Mae, the two federal agencies that oversee this market.

This makes a lot of sense. However, since the credit scoring rules reward access to traditional credit, which still is more accessible to White Americans for a lots of reasons, their practical effect is that it is government agencies that perpetuate the discrimination among lenders.

Personally…

I do not know exactly how much, how, where, structural racism is embedded in the US mortgage industry (or in any other country, for that matter). It sure is there, but the topic here is Fannie, Freddie and Classic FICO. Because that is just one more rerun of an old story I repeated the last time less than one week ago: If you want to innovate banks for real, rather than just run them faster, you must start from laws, not code.

Who writes this, why, and how to help

I am Marco Fioretti, tech writer and aspiring polymath doing human-digital research and popularization.

I do it because YOUR civil rights and the quality of YOUR life depend every year more on how software is used AROUND you.

To this end, I have already shared more than a million words on this blog, without any paywall or user tracking, and am sharing the next million through a newsletter, also without any paywall.

The more direct support I get, the more I can continue to inform for free parents, teachers, decision makers, and everybody else who should know more stuff like this. You can support me with paid subscriptions to my newsletter, donations via PayPal (mfioretti@nexaima.net) or LiberaPay, or in any of the other ways listed here.THANKS for your support!