The interesting story of a big art "transaction"

“Transaction”, in quotes. They matter here.

How could it possibly make sense to “pay $69M” (again, note the quotes) for a link to a link to a digital image? The DSHR blog just tried to answer this question.

Digital cryptocurrencies and NFTs (Non Fungible Tokens, which is the official name of what DSHR calls “links to links”).

These days, transactions based on cryptocurrencies and especially NFTs are, using DSHR’s words, “rife with… pump-and-dump schemes (P&Ds)". The DSHR blog post explains in detail several analyses of a specific transaction, the “purchase” (my quotes) of some files of digital arts called “Everdays: 20 Collection” artworks for $2.2 million in December 2020.

That transaction is interesting because:

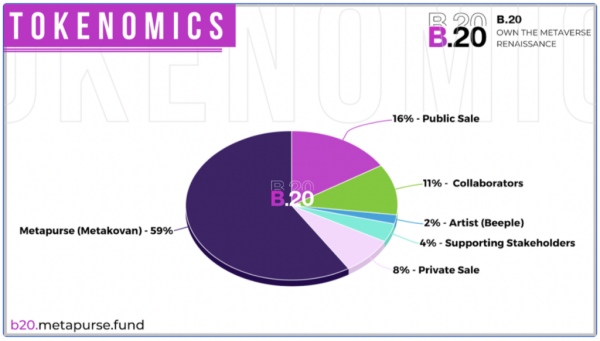

- Beeple, the creator of the artwork, is actually a business partner of Metakovan, the firm controlling the firm (Metapurse) that bought the artwork

- the transaction transferring the $60M in Ethereum cryptocurrencies (ETH) from Metakovan to Beeple and the $9M in ETH from Metakovan to Christie’s never appeared in the official Ethereum ledger (aka “blockchain”):

- no actual money changed hands, so “there was no sale of $69M worth of ETH, so no crash of the ETH market”, but the hype around the transaction “is part of the reason for ETH’s “price” surge from $1,792 the day of the sale to $4,085 in two months”.

The DSHR post has all the details about why and how this digital circus made no real money for nobody, except those who played it as if it was real.

Why I want you to know that NFT story

I strongly believe that one of the first things that we really need to deal with the big real problems of our age is new forms of money. In other words, we badly need to figure out what actual good we may build learning from today’s cryptocurrencies, and what in them, instead, is hype or scam. To learn more about both sides, do read the whole story of that “transaction”.

Who writes this, why, and how to help

I am Marco Fioretti, tech writer and aspiring polymath doing human-digital research and popularization.

I do it because YOUR civil rights and the quality of YOUR life depend every year more on how software is used AROUND you.

To this end, I have already shared more than a million words on this blog, without any paywall or user tracking, and am sharing the next million through a newsletter, also without any paywall.

The more direct support I get, the more I can continue to inform for free parents, teachers, decision makers, and everybody else who should know more stuff like this. You can support me with paid subscriptions to my newsletter, donations via PayPal (mfioretti@nexaima.net) or LiberaPay, or in any of the other ways listed here.THANKS for your support!