What on Earth are CBDCs? Money, of course

Almost like good, old, CASH money, that is.

CBDC is an acronym that stands for “Central Bank Digital Currency”. One year ago, Sweden’s national bank announced a year-long pilot experiment with its own digital currency, the e-krona. China has also been working on its own digital currency. Here, I introduce some basic concepts of CBDC, in the simplest possible format, and some pointers to to know more.

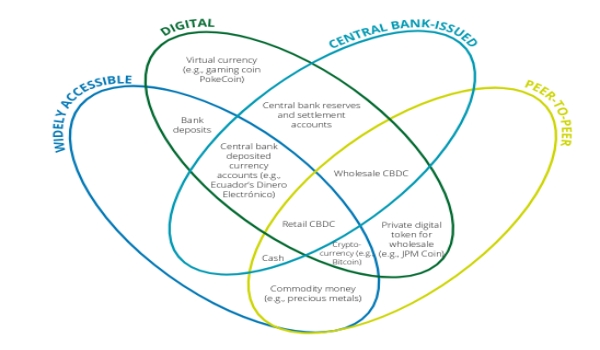

In plain English, a CBDC is just some form of exclusively digital money. The main, fundamental difference between any CBDC and “cryptocurrencies” like bitcoin, is that the former is distributed by an authority (the central bank) and not by decentralised online communities.

What does a CBDC look like?

A CBDC should be as safe and versatile as good old cash. Being issued and backed by a Central Bank, that is an organization that should care a lot about financial stability, a CBDC would also be at least as stable and trusted as the traditional, official currency issued by the same bank.

With such characteristics, a CBDC could give people a safe, reliable and universally accessible way to make and receive payments, just as cash does now. Unlike cash, however, retail CBDCs could bear interests. Also, it would be possible to create both “wholesale” CBDCs, for transactions among businesses, and “retail” CBDCs, for payments among individuals, or between individuals and businesses. The latter kind of CBDC is, of course, the most interesting one, as it would greatly change the daily life of the general public.

To really work “like cash”, a (retail) CBDC should:

- be offered to people either as deposits on their accounts at their central bank, or as “digitally issued tokens” that would be the concrete alternative to today’s banknotes and coins

- be at least as counterfeit-proof as cash

- NOT be tied to any specific technology, i.e. not require a certain model or smartphone, or any smartphone for that matter

- be usable without bank accounts or credit cards

- settle payments more or less in real time, that is without having to wait hours, or days, until the payment does shows up on somebody else’s account. BUT…

- work even when there is no constant internet access

- ideally, allow untraceable payments

Of course, the last bullet may be by far, and probably will, the hardest part to implement in practice, for political more than technical reasons. To know something more about this, we may have to wait and see how the Swedish and Chinese pilots end. Meanwhile, let’s consider what may be the most important effect of CBDCs, that is:

CBDCs for the unbanked!

Consider this (edited!!!) excerpt from Reference 2 below:

“the COVID-19 pandemic revealed some major weaknesses in the current retail payment system. One recent example is the case where almost US$1.4 billion of the US Treasury’s pandemic rescue funds were paid to more than a million deceased individuals in form of stimulus checks. Furthermore, a significant portion of vulnerable unbanked households could not cash in their stimulus funds for months."

“The real-time settlement functionality of a CBDC could be a better digital payment alternative to quickly distribute money [to people suffering from] economic crises."

See? A big reason to go full speed ahead with CBDCs is that they may be an important component of something we badly, badly, urgently need: a real, fair “reform of money and how it is managed, from creation to taxation”.

To know more

Who writes this, why, and how to help

I am Marco Fioretti, tech writer and aspiring polymath doing human-digital research and popularization.

I do it because YOUR civil rights and the quality of YOUR life depend every year more on how software is used AROUND you.

To this end, I have already shared more than a million words on this blog, without any paywall or user tracking, and am sharing the next million through a newsletter, also without any paywall.

The more direct support I get, the more I can continue to inform for free parents, teachers, decision makers, and everybody else who should know more stuff like this. You can support me with paid subscriptions to my newsletter, donations via PayPal (mfioretti@nexaima.net) or LiberaPay, or in any of the other ways listed here.THANKS for your support!