When Everything is Software

too many things go bad before you can even notice them.

My professional slogan has always been, for almost twenty years now, that:

your civil rights and the quality of your life depend on how software is used AROUND you.

Here are a few recent examples, from sectors as different (but not unrelated, of course) as air travel, politics and finance sectors, of how dangerously true that slogan of mine is.

Hidden autopilots

Speaking of the Boeing 737 Max “deadly assumptions, Farhad Manjoo rightly said:

“Before everything was software, you couldn’t make a last-minute design change on an airplane that the FAA wouldn’t notice. But when everything is software - and when FAA “loves"️ Boeing - you get two crashes before anyone realizes that something’s not right here”.

Of course, as others replying to that tweet pointed out, the real root causes are (as always) human greed and stupidity. Software, however, makes it much easier than previous technologies to make and hide certain “mistakes”. And therefore requires, since we can’t certainly go back, much more oversight and awareness, both among regulators and in the general public. That’s my whole point, really. Because this is about much more than air travel.

Don’t forget elections

Please appreciate how, if you take the tweet above and replace:

- “airplane” with “political propaganda”

- “FAA” with “media”

- “crashes” with “elections” and, finally:

- “software” with “software and digital social networks”

The result is still 100% true. And impacts many, many more people than the two Boeing 737 Max crashes, albeit without directly killing them, of course.

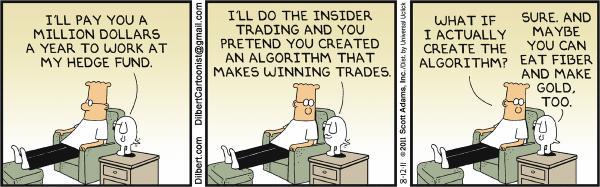

Oh, and never forget High Speed Trading

Someone said that, some day, the Stock Market alone “could eat the power grid”. Meanwhile, did you know that:

- ten years ago, the huge sums of money allocated according to instant decisions by algorithms helped create the Dow Jones single biggest decline in its history?

- in 2018, the Stock Market (that is, much of the real economy too) remains “always just one step away from massive volatility because of programmed trading”, continuing to “Fuel Wall Street Disasters”

See above about greed and stupidity, of course. Personally, I am every year more surprised that something like High Speed Trading (also known as High Frequency Trading) is even allowed to exist, really. As a very minimum, I argue that stock trades should be taxed based on the length of the holding period, as suggested here.

Image sources (follow the links to learn more on each topic!)

Who writes this, why, and how to help

I am Marco Fioretti, tech writer and aspiring polymath doing human-digital research and popularization.

I do it because YOUR civil rights and the quality of YOUR life depend every year more on how software is used AROUND you.

To this end, I have already shared more than a million words on this blog, without any paywall or user tracking, and am sharing the next million through a newsletter, also without any paywall.

The more direct support I get, the more I can continue to inform for free parents, teachers, decision makers, and everybody else who should know more stuff like this. You can support me with paid subscriptions to my newsletter, donations via PayPal (mfioretti@nexaima.net) or LiberaPay, or in any of the other ways listed here.THANKS for your support!